Massive $14 Billion Buyback Plan Unveiled by T-Mobile After Share Crash

Telecom Companies’ Quest to Boost Investor Confidence: A Tale of Two CEOs

The world of corporate finance is always abuzz with interesting developments, but few incidents have sparked such intense concern among investors like T-Mobile CEO Mike Sievert’s recent comments.

Unleashing Market Panic

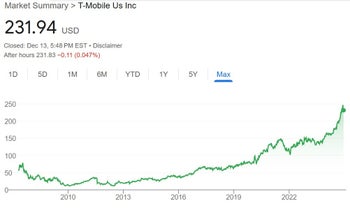

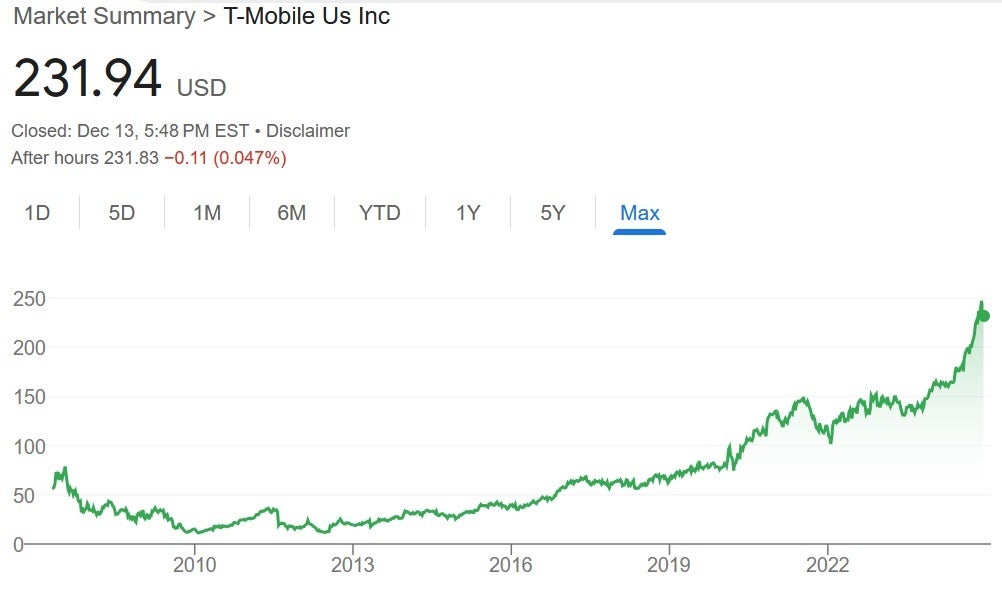

Sievert made a seemingly innocuous remark about T-Mobile’s upcoming fourth quarter, which misinterpreted by an analyst to be a warning to investors. Consequently, the market reacted by sending T-Mobile’s publicly listed shares into a downward spiral, shedding a substantial $14.92, or 6.12%, to end the week at $228.86. This notable drop represents a significant regression from its 52-week high of $248.16.

Soothing Measures Ahead

To mitigate investors’ worries, T-Mobile announced its plan to support the stock by spending approximately $14 billion. By doing so, the telecommunications giant joined the ranks of other firms that return excess capital to shareholders. But what’s behind this popular strategy? Let’s find out!

Distributing Wealth: Strategies for Rebuilding Investor Faith

So, what are the commonly employed tactics for propping up a company’s stock? These include:

- Paying out dividends

- Implementing a share buyback plan

Under a share repurchase strategy, a company buys back some of its own stock, thereby decreasing the outstanding shares. Although the prevailing market conditions determine the purchasing price, this move supposedly raises the value of remaining shares. T-Mobile itself has allocated up to $14 billion for share repurchases by the end of 2025.

Similar Strategies in Action

Colleagues in the sector, like AT&T, have been taking similar initiatives. Last month, it announced its plan to allocate over $40 billion over the next three years by combining dividend payments and share repurchases. The main goal behind these efforts: to alleviate investor concerns, boost morale, and generate long-term growth.

For now, T-Mobile shareholders seem somewhat reassured after the stock closed at $231.94 on the day the buyback program was unveiled, only marginally dipping $1.33 below its previous week’s value. Although uncertainty still persists, it’ll be exciting to monitor future developments as these telecom corporations strive to rebuild investor faith.

Note: Any image tags have been kept intact without conversion.